Your questions answered

What is Monese?

Monese is a digital-only, multi-award winning bank. You can open any of the following accounts:

- GBP account – with a UK account number and sort code, instant and free transfers through UK Faster Payments, cash top-ups and direct debits.

- EUR account – with your own account number (IBAN), instant and free transfers to another EUR account through the SEPA network, direct debits (in qualifying countries)

- RON account – with your own local account number (IBAN), instant and free transfers to and from another RON account.

How does Monese work?

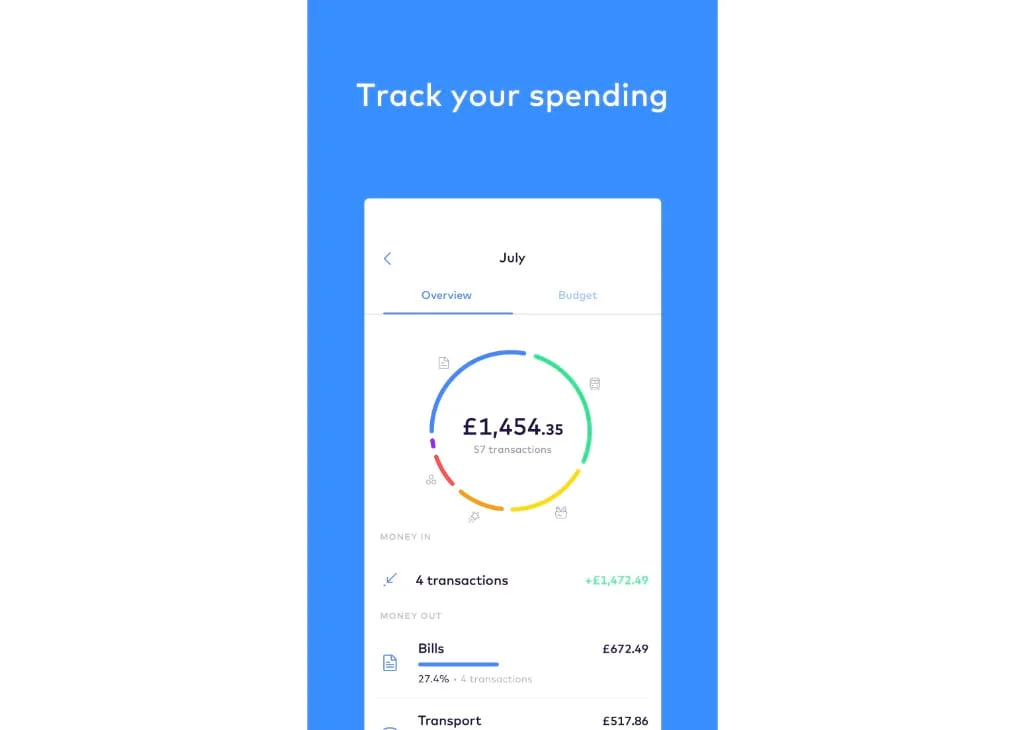

Monese is a fully functioning bank that operates in the same way as traditional banks; you can receive your salary into it, pay in cash, withdraw cash from ATMs, pay direct debits and use your card abroad. You can manage and track your spending via the app and you can also order a Mastercard contactless debit card that works anywhere in the world.

What accounts does Monese offer?

Monese currently offers 3 different personal accounts, so you can choose an account that best suits your needs (they also offer a Monese business account for £9.95 a month). Monese doesn’t tie you into any of their plans and you’re free to change your plan type anytime. Each of their accounts offers tailored allowances for ATM withdrawals, foreign currency spending and foreign currency transfers. All of their plans allow you to pay with Apple Pay and Google Pay, set up direct debits and recurring payments, open a secondary GBP or EUR account at no extra cost and send, request and receive money from other Monese users instantly.

Simple Account

|

Classic Account

|

Premium Account

|

|---|---|---|

| Monese’s Simple account has no monthly charge, however, there are some service fees for card delivery, cash top-ups and international transfers. | Monese’s Classic account is perfect for people who want to use Monese as their main bank account or use cash and international transfers often. | The Premium account is best for those who frequently use cash top-ups or withdrawals, send international currency transfers or spend money in more than one currency. |

| Contactless debit card FREE, £4.95 delivery |

Contactless debit card FREE |

Contactless debit card FREE |

| ATM withdrawals £200 free monthly, 2% fee thereafter Top up with cash from 2% fee (£2 minimum fee) |

ATM withdrawals £900 free monthly, 2% fee thereafter |

ATM withdrawals FREE |

| Foreign currency card spending £2,000 free monthly, 2% fee thereafter |

Foreign currency card spending £9,000 free monthly, 2% fee thereafter |

Foreign currency card spending FREE |

| Foreign currency transfers FREE & instant to other Monese accounts 2% fee when sending to other accounts (£2 minimum fee) |

Foreign currency transfers FREE & instant to other Monese accounts 0.5% fee when sending to other accounts (£2 minimum fee) |

Foreign currency transfers FREE & instant to other Monese accounts FREE when sending to other accounts |

| Post Office & PayPoint cash top-ups Post Office 2% fee (minimum £2) PayPoint 3.5% fee (minimum £3) |

Post Office & PayPoint cash top-ups FREE |

Post Office & PayPoint cash top-ups FREE |

How do I open a Monese bank account?

It’s simple to open a Monese bank account and unlike most other app-based banks, you don’t need to live in the UK to do so. Anyone can open an account anywhere in the UK or continental Europe. Simply download the app from the Apple App Store or Google Play Store. Once it’s downloaded, fill in some personal details and upload a photo of your ID document (driving licence, passport or National ID card). In order to verify your ID, you’ll be prompted to upload a quick video selfie. In some cases, you’ll be required to do a video call. You can make the call through the app. The video call service is open Monday-Friday from 8am to 10pm and 10am to 4pm on Saturdays. When you call, you need to have your ID documents with you.

Once your account is open, you’ll be sent a debit card in the post but if you want to use your account instantly, you can add your Monese card to your phone’s wallet and get spending straight away with Apple Pay or Google Pay.

What does the app look like?

What features does Monese offer?

Does Monese do credit checks?

No. Monese doesn’t carry out any credit checks on you when you apply for an account, so whether you have good credit history, bad credit history or no credit history, you’re eligible to open a Monese account instantly.

Can I get an overdraft or loan?

Monese doesn’t currently offer overdrafts or loans as part of their services. However, they are looking to offer credit in the form of loans in the near future.

Does Monese pay interest?

Yes, you can open an interest-bearing savings account through your Monese account. Monese have partnered with Raisin to help you build your savings further. Raisin is available in the Monese Hub and gives you access to a great choice of competitive savings products across the UK, Germany, Austria, France, the Netherlands and Spain.

Can I use Monese abroad?

Yes. You can make your money go further when travelling with your Monese debit card. They don’t charge any hidden fees and they use the wholesale exchange rate that banks get and pass the savings onto you. Monese claim that if you use their debit card abroad, you could save an average of 88%. (This percentage is based on the average cost of spending £400 from the UK to EUR, BRL, BGN, CZK, HUF, NOK, PLN, SEK or USD currency accounts outside of the UK using 5 of the UK’s leading banks. Data and exchange rates used were recorded in April 2017.)

Can I pay cash and cheques into my account?

You can top your account up with cash but they don’t currently accept cheques. Monese have partnered with the Post Office and PayPoint so you can deposit cash at over 40,000 locations in the UK. You’re able to use any Post Office brand, high-street convenience store, corner store or off-licence that has a PayPoint. If you deposit cash at a Post Office, the money will be available in your account the next working day. Depositing cash at a PayPoint is instant. But bear in mind that if you have a Simple account, you will be charged for depositing cash.

Is Monese safe?

Monese protects your account against unauthorised access with breakthrough technologies and processes to ensure that your money is safe and secure at all times. You can only access your account from a single mobile device and if you want to give another device access to your account, you have to manually authorise it through a secure multi-factor authentication process. The app is protected with a secure 5-digit passcode that only you know to prevent anyone else from taking control of you account even if they have access to your device.

If you lose your card or it’s stolen, you can block it instantly in the app. And if you find your card again, it’s just as easy to unblock it. If you’ve ever used your card in an untrustworthy location, you can simply block it and order a replacement card in the app.

Your funds are also protected with Monese. They’re a registered agent of the PrePay Technologies Limited, an electronic money institution authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of payment instruments and electronic money. Unlike banks, Monese doesn’t re-invest your funds and they keep all of their customer’s money separate to their own company finances to guarantee that if they’re no longer in business, their customer’s will receive 100% of their balance back.

Can I switch to Monese?

Monese is not currently part of The Current Account Switch Service.

How does Monese compare to other app-based banks?

We compared 5 app-based banks, taking into consideration Monese reviews from customers who have had first-hand experience with the apps. We rank providers exclusively on customer experience and product quality and the below table shows you how Monese compares to its competitors.

Review Score

Monthly Account Fees*

Maximum Overdraft**

ATM Withdrawal Limit***

Protection****

Review Score

Monthly Account Fees*

Maximum Overdraft**

ATM Withdrawal Limit***

Protection****

Review Score

Monthly Account Fees*

Maximum Overdraft**

ATM Withdrawal Limit***

Protection****

Review Score

Monthly Account Fees*

Maximum Overdraft**

ATM Withdrawal Limit***

Protection****

Review Score

Monthly Account Fees*

Maximum Overdraft**

ATM Withdrawal Limit***

Protection****

**The maximum overdraft amount you can borrow on a current account.

***This is the maximum amount you can withdraw from an ATM machine per day.

****The Financial Services Compensation Scheme is the UK's statutory Deposit insurance and investors compensation scheme for customers of authorised financial services firms. The FSCS protects up to £85,000 of your money.

Was this article helpful?