Relax.

Get the best  insurance for your pet.

insurance for your pet.

Get a Quote

Protect your little friend from accidents

Accident only pet insurance will keep your pet safe if they suffer any accidents. You’ll be able to immediately take it to a vet and have it seen to without worrying about the vet bill.

Get a Quote

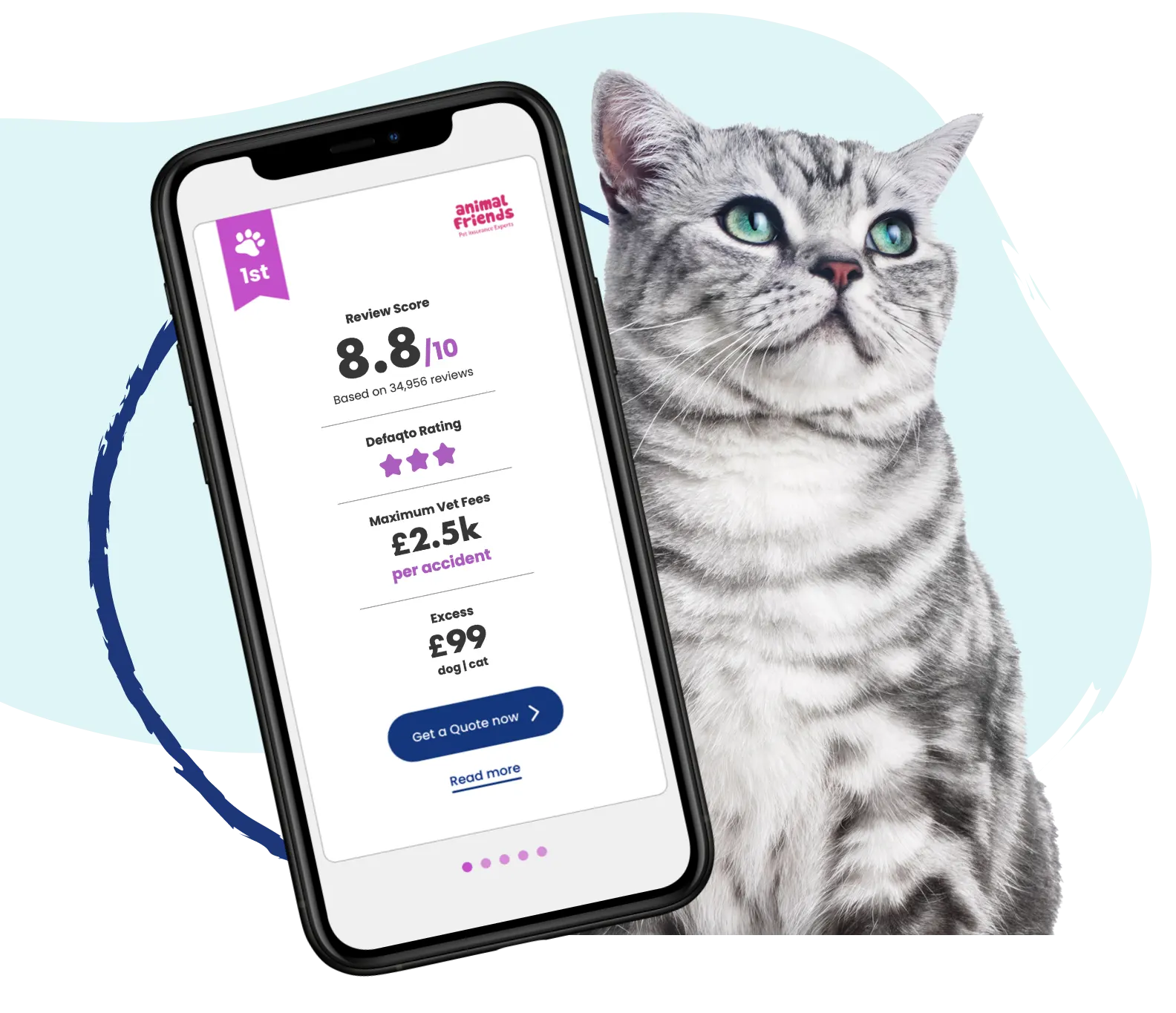

Top Rated Providers

We compare product ratings and reviews from the most trusted providers of pet insurance in the UK. Our comparison table is ordered by review score. The review score is the average weighted score based on product quality and user reviews from the last 12 months. Find out more about how our review score is calculated.

Most accident only pet insurance quotes are provided via Quotezone, who are FCA regulated.

Please note that some of the providers included within our table are not currently offering new policies.

Paws and reflect: Discover the ideal pet insurance coverage today!

We aggregate reviews from 10,000s of real customers to offer transparency and choice on one page – helping you make the best decisions for your pet. Why don’t you see what pet owners who have secured their pet insurance through Compare By Review have to say?

How it works

As an FCA-regulated business, Compare By Reviews is best-placed to get you the best accident-only pet insurance on the market. With our comparison tables, you can secure the best deal for you and your four-legged friend!

Use our Review Scores to identify top pet insurance providers.

Start a FREE pet insurance quote on our platform.

Tell us your pet’s details and medical history.

Get a quote for quality pet insurance in less than 60 seconds.

No gimmicks, no tricks – just the best for your furry friend.

Read the reviews before deciding

85% of consumers read reviews before purchasing insurance. While price is often the most visible point of difference between insurance policies, it’s important to read reviews and find out how well these services are actually delivered when needed. You don’t want to find out at the wrong moment that your policy doesn’t cover an illness you need covered, which is why you need to read the reviews.

When it comes to your precious pets, don’t compromise and make sure you pick the right policy.

In this Guide

- What are the pros and cons of accident only pet insurance?

- How does accident only pet insurance work?

- Is accident only pet insurance right for me?

- What other types of pet insurance can I get?

- Compare pet insurance providers

What are the pros and cons of accident only pet insurance?

Pros:

-

Premiums are less expensive than other pet insurance policies.

-

Good choice for young pets who are unlikely to have health conditions.

Cons:

-

Only covers your pet for accidents.

-

There’s likely to be a cap on how much you can claim for each accident.

- Most policies tend to last 12 months so ongoing treatment won’t be covered.

How does accident only pet insurance work?

Accident only pet insurance pays out a fixed sum towards each accident your pet suffers from. Some policies also cover illnesses that are caused as a result of the accident too but this isn’t very common. You should read your policy details thoroughly to see what your pet accident insurance covers.

As with all pet insurance policies, there’s typically a cap and time limit on the cover. If you want your pet to receive coverage continuously, you need to keep your monthly payments up to date and renew your accident only dog insurance or cat insurance at the end of each policy term.

Is accident only pet insurance right for me?

You might think that an accident only policy is appealing because it’s the cheapest pet insurance available. But it’s important that you understand that accident only policies offer no cover or very limited cover for illnesses. Illnesses can tend to cost more in the long run, particularly if you have a pedigree cat or dog that is known to suffer from hereditary diseases. If you take out an accident only pet insurance whilst your pet is young and they develop a lifelong condition such as arthritis, you will be unable to claim for this condition for as long as your pet needs treatment for it. Basic treatment for arthritis can cost around £5,475 a year. You won’t be able to claim any of these costs back if you have an accident only policy. Even if you want to change insurer or change policy type in the future, you would have to declare the condition as pre-existing and cover for that particular condition would be excluded. It’s really important to bear this in mind if you’re considering an accident only policy because your pet could end up becoming a financial burden in the future if you opt for a cheaper, less comprehensive policy when they’re young.

What other types of pet insurance can I get?

There are three other types of pet insurance policies available:

-

Time limited pet insurance – covers vet fees for a year, once the year’s up, you’ll have to pay for further treatment.

-

Lifetime pet insurance – covers vet fees for the whole of your pet’s life provided you renew the policy each year.

-

Maximum benefit pet insurance – protects your pet from accidents and illnesses up to a maximum amount per condition.

Compare accident only pet insurance providers today

Compare pet insurance providers on Compare by Review today. We’re the first and only comparison site that ranks pet insurers exclusively on customer experience and product quality rather than price. Our full table of pet insurance providers gives you an impartial and unbiased overview so, whether you’re after accident only dog insurance or accident only cat insurance, you can purchase a policy from a high-quality provider that you can rely on when you need them most.

Accident Only Pet Insurance Guides

Check out our insurance guides for more information