Relax.

Get the best  insurance for your pet.

insurance for your pet.

Get a Quote

Find the right lifetime insurance for your pets.

Get your pets covered from accidents and injuries by securing the best lifetime insurance coverage. We scour the web, finding the UK’s top-rated insurance deals – so you don’t have to.

Get a Quote

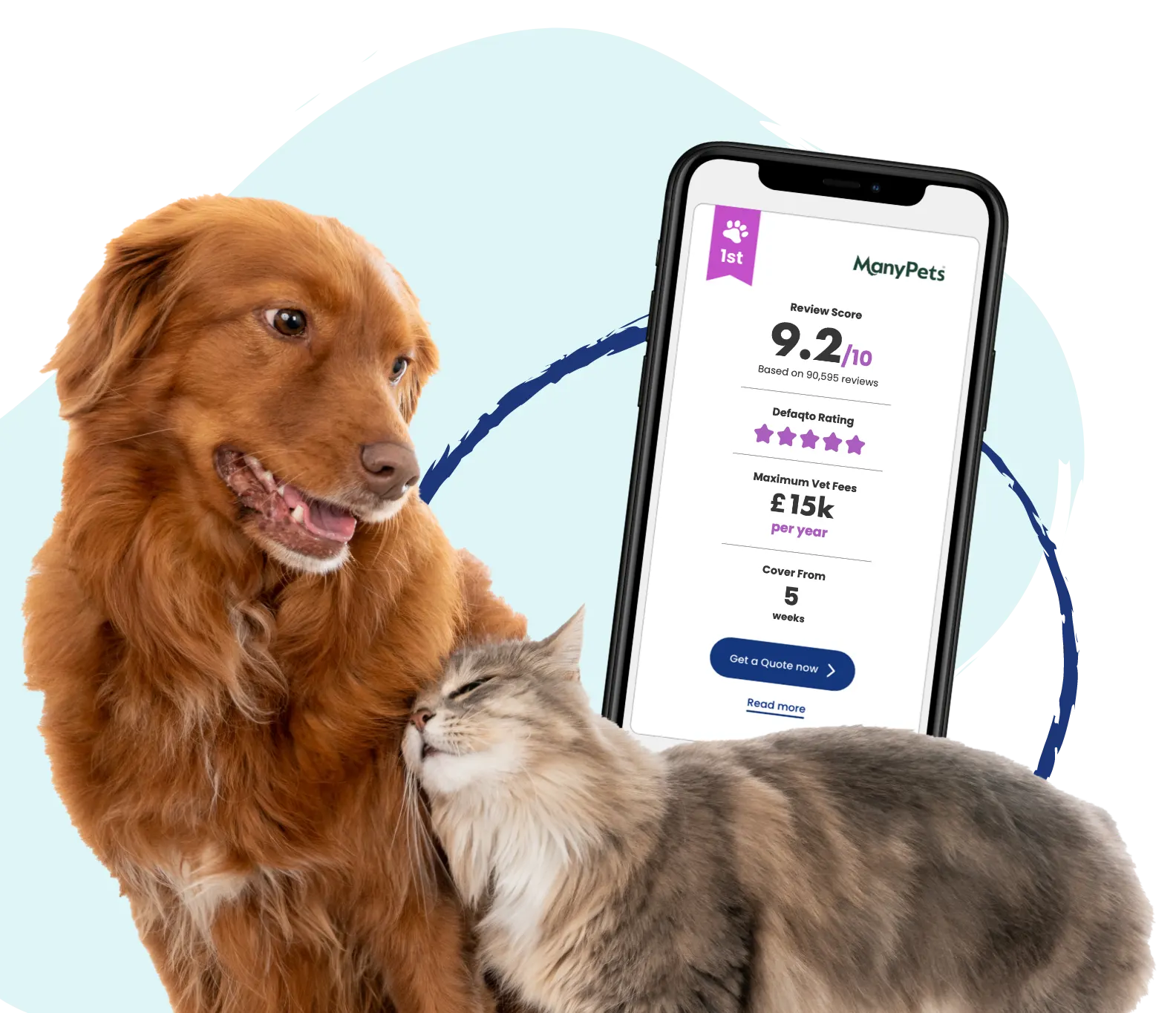

Top Rated Providers

Our comparison table is organised by review score, a weighted average of product quality and user feedback from the past year. Click here to find out how we calculate our review score.

Most lifetime pet insurance quotes are provided via Quotezone, who are FCA regulated.

Please note that some of the providers included within our table are not currently offering new policies.

1000s of reviews, all in one place

We have reviews from 1000s of real customers to offer transparency and choice on one page — helping you make the best decisions for your pet. See what other pet owners who have secured their lifetime pet insurance through Compare By Review have to say.

How does it work?

We help you find the best cat insurance on the market with our easy-to-use comparison tables!

Use our Review Scores to identify top cat insurance providers.

Begin your FREE lifetime insurance quote on our platform.

Tell us your cat’s details and medical history.

Get a quote for quality lifetime insurance in less than 60 seconds.

No hassle, no tricks — just the best cover for your pets.

In this Guide

- What are the pros and cons of lifetime pet insurance?

- Compare lifetime pet insurance

- What does lifetime pet insurance cover?

- Can I claim for the same condition each year?

- Is lifetime pet insurance right for me?

- How much does lifetime pet insurance cost?

- What other types of pet insurance can I get?

- Compare pet insurance providers

What are the pros and cons of lifetime pet insurance?

Pros:

-

Covers chronic conditions.

-

Covers hereditary conditions.

-

Protects you from the cost of ongoing treatment.

Cons:

-

Premiums can be costly compared to time limited policies.

-

You have to stay with the same provider each year to benefit.

- Once you’ve reached the maximum set limit, you’ll have to pay the rest.

Compare lifetime pet insurance

There are two different types of lifetime pet insurance you can get. Annual limit per condition and condition limit:

Annual limit per condition

Pet insurance with lifetime cover often has an annual limit per condition. If this is the case for your pet’s lifetime cover, you’ll be able to claim a maximum amount for each condition your pet develops. For example, your policy could have a condition limit of £7,000. If your dog developed diabetes and the vet bills for the year came to £5,000, the cost would be covered by the policy. However, if the vet bills came to £7,500 for the year, you’d have to pay out the remaining £500. If you renew the cover at the end of the year, the limit would be reset.

The benefit of having an annual limit per condition is that if your pet is unfortunate enough to develop more than one condition, you can claim the maximum amount for the treatment of each condition.

Condition limit

Pet insurance with lifetime cover that has a condition limit allows you to claim a set limit per condition for life. For example, if the lifetime limit is £50,000, you can claim up to £50,000 for each condition throughout your pet’s life, as long as you renew the policy every year.

What does lifetime pet insurance cover?

This will vary depending on the provider you choose. The best lifetime pet insurance policies will include cover for:

Vet fees

Vet fees are normally covered up to a maximum financial limit per year. The limit is reset each year you renew your policy.

Kennels/cattery costs

If for any qualifying reason you can’t care for your pet for a while, your insurer might cover kennel or cattery costs up to a financial limit per year.

Third-party liability cover

If your dog is responsible for injuring someone or damaging their property, third-party liability cover protects you against costs that you’d be liable to pay and any legal fees involved. This cover isn’t available for cats as owners aren’t liable for their actions.

Compensation if your pet is stolen or missing

Lifetime pet insurance policies might contribute towards any costs associated with your pet going missing, such as advertisement campaigns and a reward to help get your pet back home safely.

Compensation if your pet passes away

If your pet passes away due to an illness or accident, you could claim back the price you paid for them. Most policies have an age limit and financial limit.

Euthanasia, cremation and burial

To help relieve the stress and heartache associated with losing your cuddly companion, most insurers will make a contribution towards the costs of these services.

Can I claim for the same condition each year?

Yes. If you have pet insurance with lifetime cover you can claim for the same condition year after year. However, the way this works will depend on the type of lifetime pet insurance policy you have.

For example, f you have a policy with a condition limit, you can claim up to that maximum limit throughout your pet's entire life. If they develop arthritis one year, you can keep claiming year on year for arthritis until you've met the condition limit. Once you've reached the limit, you won't be able to claim for arthritis again, but you can continue to claim for other conditions.

If you have an annual limit per condition, you can claim up to the condition limit each year for the same condition. For example, if your annual limit per condition is £7,000 and your pet develops arthritis, you can claim up to £7,000 in the first year and this limit resets each year after. So, you can continue to claim up to £7,000 each year for the condition, provided you renew your policy.

Is lifetime pet insurance right for me?

Lifetime pet insurance is the most comprehensive type of pet insurance available so it’s hard to think of reasons why it wouldn’t be a good choice for you and your pet. The main reason why you might want to opt for a different type of policy is because lifetime policy premiums are high compared to the likes of accident-only and time-limited premiums.

How much does lifetime pet insurance cost?

Based on Compare by Review data from November 2020, a lifetime dog insurance policy for a healthy four-year-old Labrador costs £31.30 per month on average and a lifetime cat insurance policy for a healthy three-year-old Bengal costs £13.62 a month on average. Whilst this might seem like a lot of money to pay each month, you should remember that there is no NHS for pets, so if you don’t have pet insurance, you’ll have to pay the entire vet bill out of your own pocket. Lifetime pet insurance is the best way to protect yourself from the cost of ongoing treatment.

What other types of pet insurance can I get?

There are three other types of pet insurance policies available:

-

Time limited pet insurance – covers vet fees for a year, once the year’s up, you’ll have to pay for further treatment.

-

Maximum benefit pet insurance – protects your pet from accidents and illnesses up to a maximum amount per condition.

-

Accident only pet insurance – provides cover for accidents only.

Compare pet insurance providers

Find the best lifetime pet insurance for your pet and compare pet insurance providers on Compare by Review today. We’re the first and only comparison site that ranks pet insurers exclusively on customer experience and product quality rather than price, taking into account lifetime pet cover reviews from real customers. Our full table of providers gives you an impartial and unbiased overview so you can purchase pet insurance from a high-quality provider that you can rely on when you need it most.

Lifetime Pet Insurance Guides

Check out our insurance guides for more information